The 2024 Bitcoin Crash - The Crash is Inevitable?

Share

See: https://m.youtube.com/watch?v=LYWpyoTox4s

Also see:

3 events that will determine the fate of cryptocurrencies

See another essay:

After $2 trillion crypto crash, what happens next?

Crypto dominos: the bursting crypto bubbles and the destiny of digital finance

Keynote speech by Fabio Panetta, Member of the Executive Board of the ECB, at the Insight Summit held at the London Business School

London, 7 December 2022

It is a true pleasure to be back at the London Business School.[1] I did my PhD here many years ago. As soon as I arrived, I found myself immersed in an environment where pioneering academic research and economic analysis were carried out in a friendly atmosphere. In those years I learned not only to be rigorous in doing research, but also the importance of doing one’s job with enthusiasm.

I still have vivid memories of stimulating and motivating discussions with my fellow students and the faculty. I am particularly grateful to my PhD supervisor and dear friend, Professor Richard Brealey.

Moving from the past to the future, today I will discuss crypto-assets and the destiny of digital finance.

When I last spoke about crypto finance at Columbia University last April, I likened it to the Wild West and warned about the risks stemming from irrational exuberance among investors, negative externalities and the lack of regulation.[2]

Crypto markets have since witnessed a number of painful bankruptcies. The crypto dominos are falling, sending shockwaves through the entire crypto universe, including stablecoins and decentralised finance (DeFi).[3]

The crash of TerraUSD, then the world’s third-largest stablecoin, and the recent bankruptcy of the leading crypto exchange FTX and 130 affiliated companies each took only a few days to unfold. This is not just a bubble that is bursting. It is like froth: multiple bubbles are bursting one after another.

Investors’ fear of missing out seems to have morphed into a fear of not getting out.

The sell-off is exposing those “swimming naked”.[4] It has laid bare some unbelievably poor business and governance practices across a number of crypto firms. It has revealed that some investors have been acting carelessly by investing blindly without proper due diligence. And similar to the sub-prime crisis, the crash has uncovered the interconnections and opaque structures within the crypto house of cards.

This is set to dampen enthusiasm in the belief that technology can free finance from scrutiny. The crash has served as a cautionary reminder that finance cannot be trustless and stable at the same time. Trust cannot be replaced by religious faith in an algorithm. It requires transparency, regulatory safeguards and scrutiny.

Does this mean we are witnessing the endgame for crypto? Probably not. People like to gamble. On horse races, football games and many other events. And some investors will continue to gamble by taking speculative positions on crypto-assets.

Today I will argue that the fundamental flaws of crypto-assets mean that they can quickly collapse when irrational exuberance subsides. We should therefore focus on protecting inexperienced investors and preserving the stability of the financial system.

Ensuring that crypto-assets are subject to adequate regulation and taxation is one path to achieving this. Here, we need to move rapidly from debate to decision and then implementation.

But even regulation will not be enough to address the shortcomings of cryptos. To harness the possibilities of digital technologies, we must provide solid foundations for the broader digital finance ecosystem.

This requires a risk-free and dependable digital settlement asset, which only central bank money can provide. And that is why the ECB is working on a digital euro while also considering new technologies for the future of wholesale settlement in central bank money.

Fundamental flaws in crypto finance

The philosophy behind cryptos is that digital technology can replace regulated intermediaries and avoid state “intrusion”. In other words, that it is possible to build a trustless but stable financial system based on technology.

This is just an illusion, as was clear from the outset and confirmed by recent developments. In fact, it is precisely the absence of regulation and public scrutiny that blinded investors to the risks involved, leading to the rise and subsequent fall of crypto-assets.

The risks associated with crypto finance stem from three fundamental flaws. I will address each of them in turn.

Unbacked crypto-assets offer no benefits to society

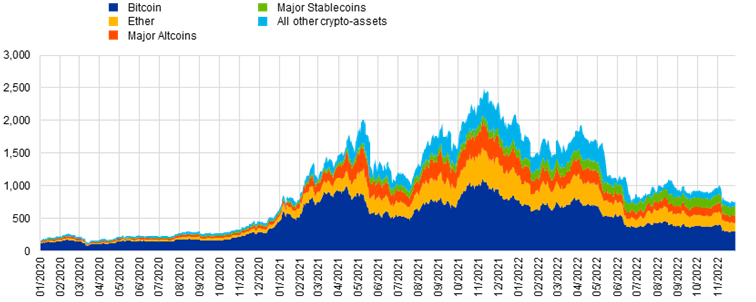

The main structural flaw of unbacked crypto-assets – which form the bulk of the crypto market (Chart 1) – is that they do not offer any benefits to society.

Chart 1

Market capitalisation of crypto-assets

(EUR billions)

Sources CryptoCompare and ECB calculations.

Notes: Crypto-asset market capitalisation is calculated as the product of circulating supply and the price of crypto-assets. If the circulating supply were adjusted for the lost bitcoins which are proxied by those that have not been used for longer than seven years, it would be around 20% lower. The selected major altcoins are Cardano (ADA), Bitcoin Cash (BCH), Dogecoin (DOGE), Link (LINK), Litecoin (LTC), Binance Coin (BNB), Ripple (XRP), Polkadot (DOT) and Solana (SOL). The selected major stablecoins are Gemini USD (GUSD), True USD (TUSD), USD Coin (USDC), Tether (USDT), Binance USD (BUSD) and Pax Dollar (USDP). Algorithmic stablecoins were excluded.

Despite consuming a vast amount of human, financial and technological resources, unbacked crypto-assets do not perform any socially or economically useful function. They are not used for retail or wholesale payments – they are just too volatile and inefficient.[5] They do not fund consumption or investment. They do not help fuel production. And they play no part in combating climate change. In fact, unbacked crypto-assets often do the exact opposite: they can cause huge amounts of environmental damage.[6]They are also widely used for criminal and terrorist activities, or to evade taxes.[7]

As a form of investment, unbacked crypto-assets lack any intrinsic value. They have no underlying claim: there is neither an issuer who is accountable and liable, nor are they backed by collateral. They are notional instruments, created using computing technology, which do not generate financial flows[8] or use value for their holders. Therefore, their value cannot be estimated from future income discounted to the present, like for real and financial assets.

Unbacked crypto-assets cannot help to diversify portfolios. Recent developments show that their value does not increase when income becomes more valuable to consumers – such as in periods of high inflation or low growth. Crypto-assets are not digital gold. Their price changes show increasing correlation with stock markets (Chart 2), with much higher volatility. And recent developments highlight their intrinsic instability: the first bitcoin exchange-traded fund lost more on its price since its launch than any other that has been issued.[9]

See the full essay here:

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp221207_1~7dcbb0e1d0.en.html